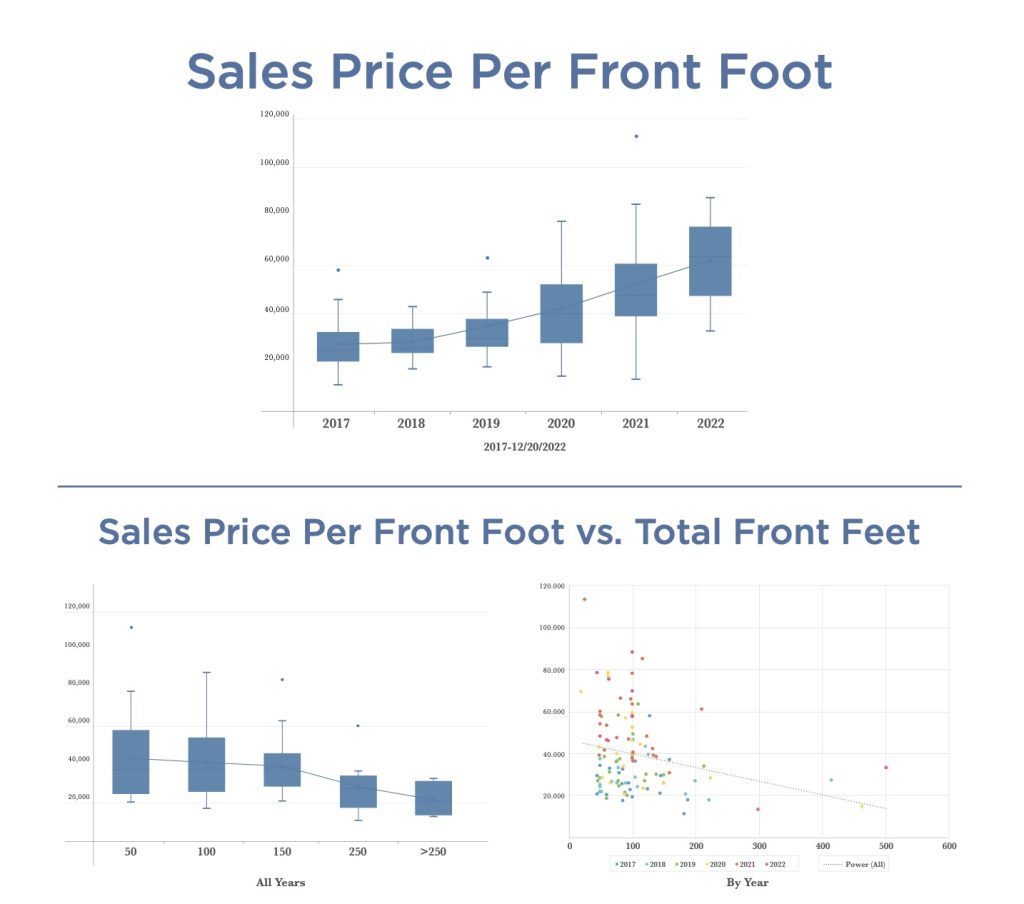

Lake Geneva’s favorite metric is also one of my least favorite: The Price Per Front Foot. I generally disapprove of the importance that the market places on this defining metric, but I’d never pretend that it doesn’t matter. This revered metric has increased over the past five years from mid $20K to now just over $60K for both average and median. I intentionally left vacant land sales out of this detail, though it would be expected that a significant proportion of our single family sales have sold at land value as the market has a voracious appetite for new construction and sees most aged structures as tear down candidates.

Something that’s not well understood is that the price per foot of frontage decreases as frontage increases. You can think of this as diminishing returns to frontage size, or price compression as you move to the larger properties on the lakefront. The idea is simple: If a high quality lakefront home on 50’ of frontage can now sell for $5M, that doesn’t mean an average home on a 200’ lot gets to sell for $20M. Do not make the mistake of assuming the price per front foot holds up as frontage increases.

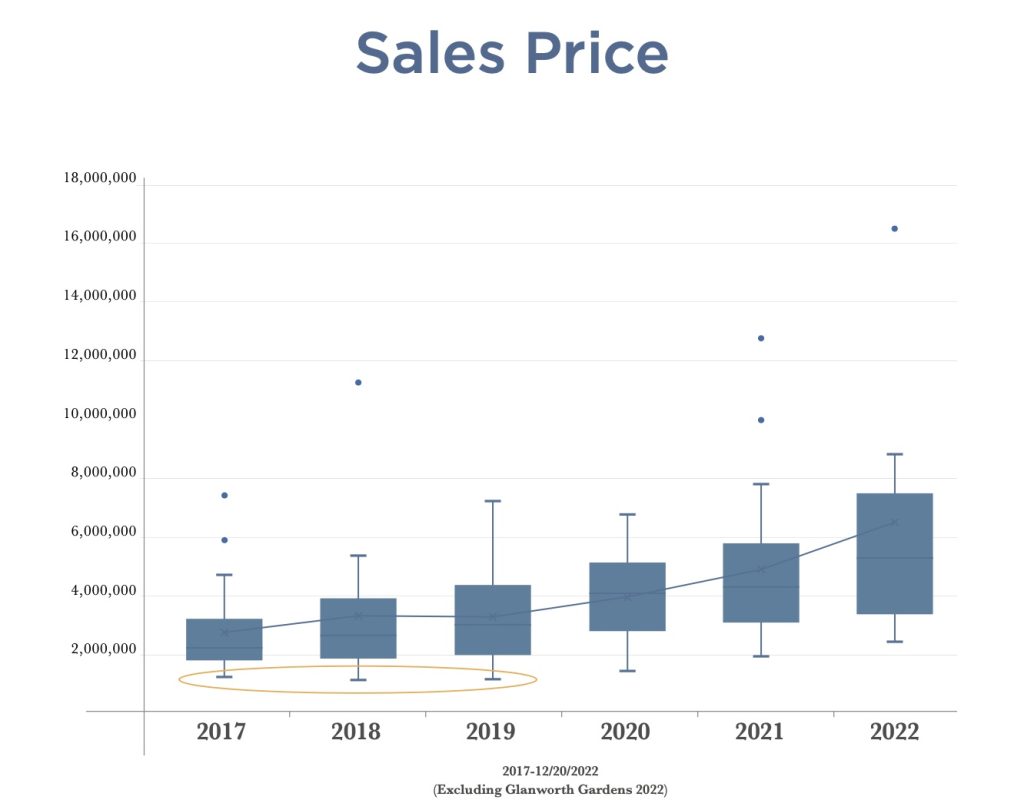

The remarkable consistency of entry level lakefront pricing was on display for fifteen years, from circa 2003 through 2018, during which a buyer could have almost always expected to find a lakefront home priced between $900k and $1.25M. To support that point, consider I sold a Geneva lakefront home on Maytag in 2001 for $907k, and I sold a similar lakefront home on Lakeview in 2017 for $925k. The minimum price of entry to lakefront held steady at around $1M for the first 3 years of the sample period (see highlighted section in chart above), increased to ~$1.4M in 2020, just under $2M in 2021 ($1.9M) and blew through $2M ($2.375M) in 2022. Entry level lakefront today is likely operating in the $2,500,000 to $3,500,000 range, and I can’t see that range shifting lower ever again. The absence of existing inventory (not listed, but that potential inventory as it exists on the lakefront), and the incredibly consistent supply of entry level buyers will continually support this range as our new floor.

2021 and 2022 saw more ‘outlier’ sales as conventionally defined in these box plots, and these outliers are generally skewed more to the upside. Aside from the $9.95M print in 2016, the highest outlier pre 2021 was the $11.25M print in 2018. 2021 saw two conventionally defined outliers and 2022 also had two, those at $16.5M and $36M. The market has incredible strength at the upper end, a notable shift from just six years ago when a $10M sale was seen as a rare event. Today, buyers have confidence that there is future liquidity in this range and sales should continue with frequency. The unique nature of the Lake Geneva market’s upper bracket was made obvious in early 2022 when I represented the sale of Glanworth Gardens. Legacy estates on Geneva had not proven their open market valuations in the last two decades and I would expect this sale to provide a benchmark against which all other legacy estates, and their respective values, are measured. No other single family market in the Midwest has this variety of strength in these upper valuation ranges.

Information deemed reliable but in no way guaranteed. Data pulled from MLS and known sales, single family residential with private frontage only. Excludes auction sales. Data through 1/1/22-12/28/22.