It’s rather obvious that Lake Geneva isn’t as interest rate sensitive as most real estate markets. I’ve been saying for the better part of the past year that I’d be short many of the housing markets that have benefited from the great migration, and I continue to believe that those markets are likely to suffer some more serious valuation destruction than a market like Lake Geneva. I’m looking at you, boring Florida towns. At some point, you run out of people willing to move to Florida and Texas. I live in a high tax state with a few clouds once in a while, and I’m not moving no matter what. There are still people who value the concept of home, and I’m going to bet we’re running out of the population that doesn’t feel a sense of loyalty to their home. Even so, long term interest rates are a crucial element to the business of real estate, which is another obvious truth even though market participants the world around are busy pretending that it isn’t true.

Interest rates are especially important to those markets that are built on the backs of short term rentals. If you’re a market rife with short term rentals, your market likely has a whole lot of debt on its collective balance sheet. This is rather terrifying for those markets, especially when considering a fair amount of aggressive airbnb owners likely didn’t shy away from adjustable rate produces over the last several years. And even if they did, consider that a bull market built on volume that requires investor participation has become reliant on that component, and if rates rise to such a degree that the rents cannot rise commensurate, you can imagine the trouble that might create for said market.

But back to the Lake Geneva market and the year just ended. Because of the print date of my winter magazine, my 2022 charts had to stop just short of the year end, so my graphs will not include one MLS sale that occurred on December 29th, that of a lakefront in Lake Geneva with a shared pier just under $5M (I didn’t have any part in that transaction). So my stats will include all MLS deals, except that one, and will include all known to me off market deals. I didn’t include the auction property in Cedar Point that printed in the mid $6s, because the auction process was not necessarily indicative of open market value, though in this case it was pretty close. My stats for these year end reviews will also only include single family residential, which excludes the South Shore Club and any other property with communal or otherwise shared frontage.

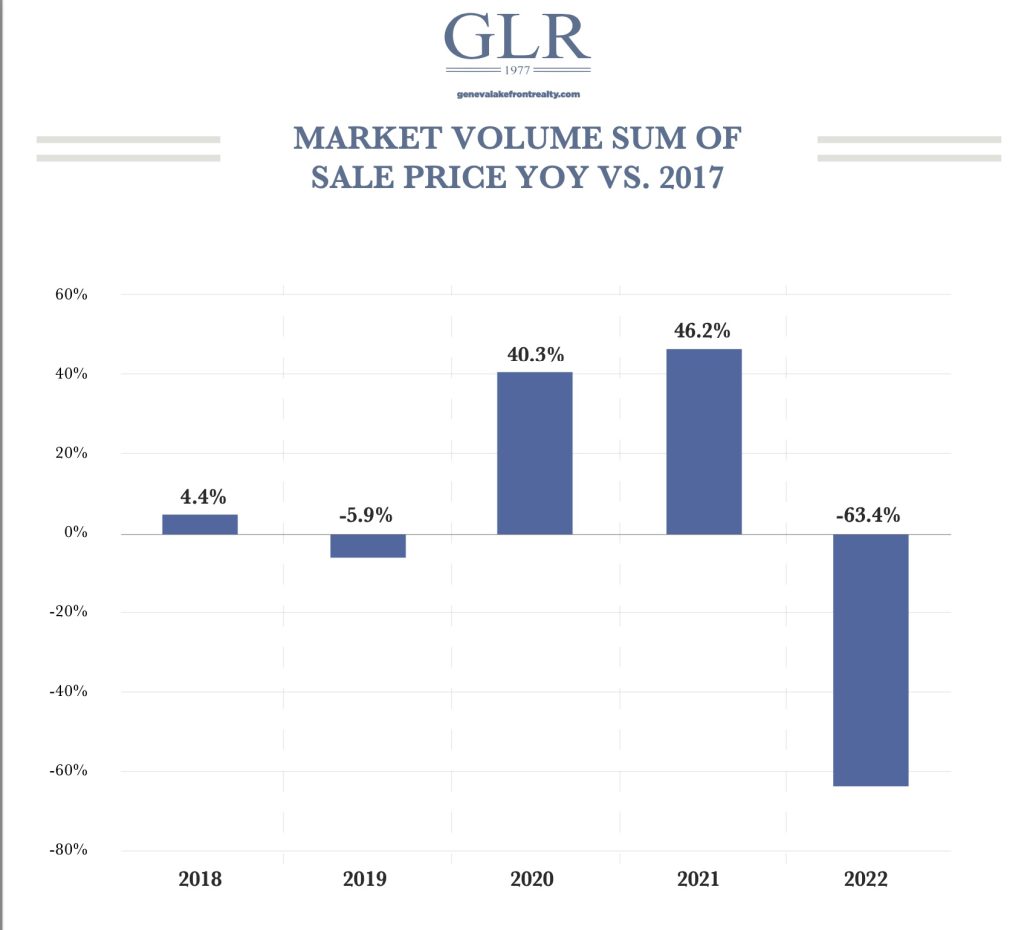

The chart above will appear, at first blush, to be a negative indicator. This is common across all markets, as casual onlookers perceive any decline in volume to represent a falling or otherwise unfavorable market. In this case, that couldn’t be further from the truth. Volume was down for 2022, but that’s because inventory was almost entirely absent. After the burst of activity during the first two covid years, the market nearly seized up during 2022 as it was starved of inventory. I can only imagine how many would-be buyers left the Lake Geneva market for another (lesser) market simply because our inventory was so tragically light. I can’t help but see this as a mistake, but I won’t say I blame those buyers. This market can be wildly frustrating, and sometimes life doesn’t let us be patient.

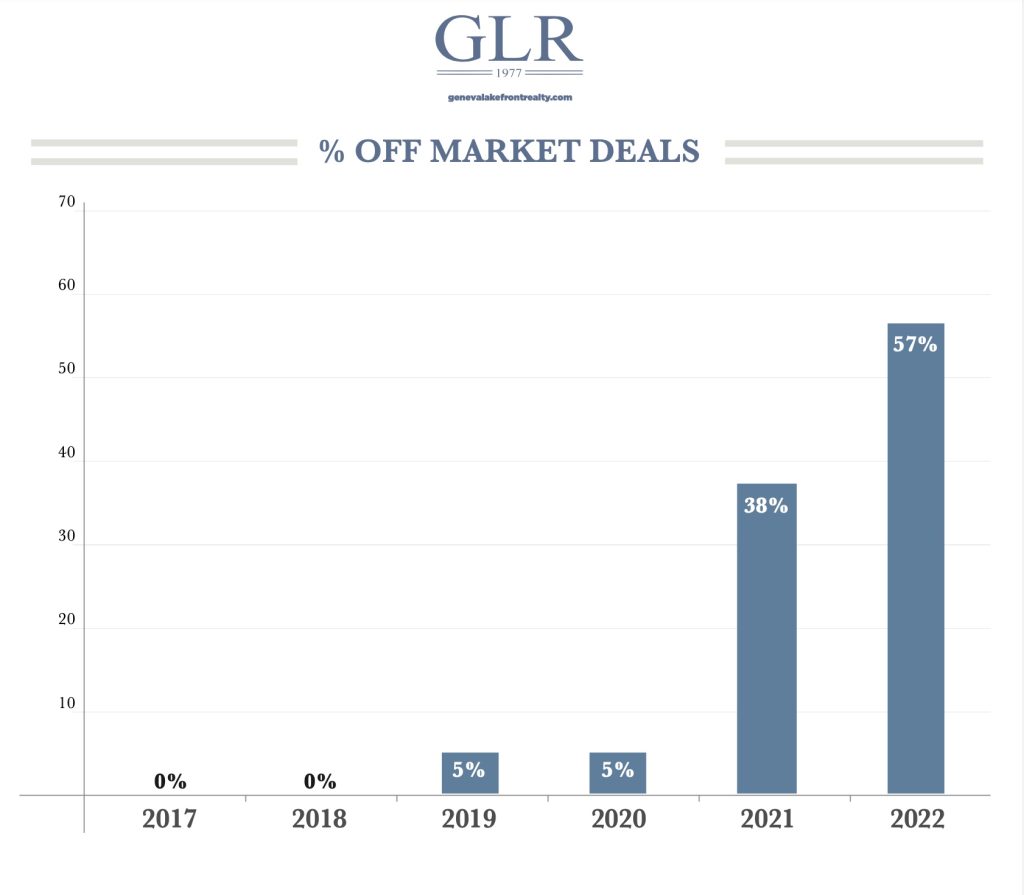

The chart below shows what almost all market participants already know: This is the era of the off-market transaction. Some will decry this sales method, though it should be noted that people usually only pout about it until it works in their favor. Off market transactions have been gaining incredible momentum in our market, and for good reason. If a seller can sell at his or her terms, without subjecting the property to the open market, why wouldn’t they? The argument against this practice is that the open market very well might provide a higher price for that seller, and this is, of course, potentially true. But this isn’t a zero sum game, as a property exposed to the open market has no choice but to suffer valuation destruction if the property sits on the open market. Look to luxury real estate headlines the world around and you’ll see examples of open market valuation misses and their ultimate sales prices. Elevated market time does not come without a penalty, and that penalty is nearly always a diminishment in value. For the five year period just ended, we saw off market deals of from 0% in 2017-2018 to making up more than 57% of the total market volume in 2022. As the market slowly returns to a more normal pattern I would expect off-market deals to become less common than they were in the year just ended, but to me, off market deals will always be a valuable tool in working with sellers to achieve their desired results.

Charts deemed reliable but in no way guaranteed. Data compiled from MLS and known sales 1/1/2022-12/28/2022 single family residential with private frontage.