There’s an interesting bit of information available this morning courtesy a recent lakefront sale. The sale was of an older house on a 90′ lakefront lot in the Birches. The property was fine. The MLS description made no mention of it, but I believe the house may have been a Zook. Zook homes are a lot like Frank Lloyd Wright homes, in that the sellers care about the pedigree of the architect, but the market doesn’t. This property was initially listed for $3.5MM back in 2008, and after a series of price reductions and listing pauses, the property mercifully sold this week for $2.3MM. I didn’t have the listing or the buy side, which is pretty awful for me but worse for the buyer and seller.

The parcel of land was reasonably decent, though I don’t count Maple Lane to be among the best streets on the lake. It’s a fine street with fine homes, but it’s not necessarily a street that has a history of selling for elevated prices. Today isn’t about that parcel, it’s about the market context of this sale. Brokers are clamoring over potential listings to such an extent that prices are being driven up less by market conditions and more by the breathlessness of agents who are new enough to the business that they have no way to be sure of valuations. It’s not their fault, they’re just chasing dollars. To understand what this sale means to the market we must first look back at some very recent history.

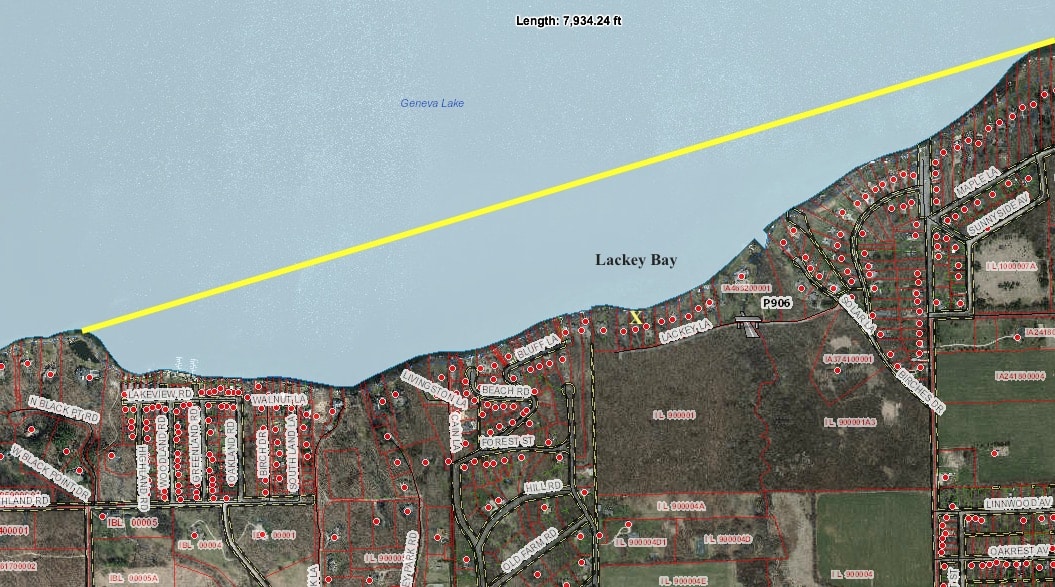

In 2016 I sold three lakefront homes on Lackey Lane. Of those three, two were modest homes, one of which has since been torn down while the other was renovated. Those two properties that sold at land value printed at $1.9MM and change, for 100′ lots on a really desirable street. Geographically, Lackey and Maple are close, so we’ll consider them to be likely comparables for each other, even though I find Lackey to be far more appealing. Those two sales printed at around $19,000 per front foot. This isn’t some long ago number, this is 24 months ago. Market conditions today have improved, but market conditions in 2016 were still quite good.

The recent sale on Maple printed at $25,555 per front foot. The overall land mass at Maple was larger than Lackey by two fold, but the market pays little attention to overall mass and focuses instead, perhaps at times incorrectly, on frontage. The Maple sale closed 34% higher than the 2016 sales on Lackey. Does this mean the lakefront market has appreciated 34% in the past 24 months? Of course not. Does it mean that some properties have appreciated that much in such a short period of time? Absolutely yes.

In 2016, those Lackey sales were not easy sales. Both properties endured some time on market. Both properties were overlooked, even by smart buyers who were working with me. Today, the Maple property proves out what I knew then: 100′ vacant lots that are selling at land value are becoming increasingly rare. Just as we’ll someday run out of dumpy lakefront cottages that you might be able to buy for $1.2MM, we’re also running out of 100′ lakefront lots with older, modest homes on them. This scarcity is driving up prices in both categories, though the entry level market remains rather stagnant compared to the 100′ market. Expect this trend to continue as buyers seek out properties that offer them some upward mobility should they one day decide to build new, or undertake a serious renovation.