Between the true lakefront homes and the regular old association homes there exists another breed of real estate. The lakefront seeker is one who usually must have at least $1.2MM to bring to the closing table, and the association home dweller is one who generally finds value between $200k on the very low end and $900k on the very high end. In between where these two worlds nearly, but cannot quite collide, lies a tricky little bit of our market. For brevity’s sake, this segment shall be known as the “sort-of-almost-kind-of-like-lakefront-but-not-entirely”.

These homes exist in many locations, and you’re correct to surmise that they are defined more by price range than they are by pure location. Glenwood Springs has a lakefront technically made up of association homes lining an association parkway. But, the market prices paid for these homes closely mirror private frontage prices because the market treats these non-lakefront homes as if they are indeed lakefront. Where they exist in the capacity I’m describing today is quite wide ranging, from a single home in the Loch Vista Club to two homes in Oakwood Estates, to a home or two scattered here and there around the 22 miles of shoreline that we all would prefer to call home.

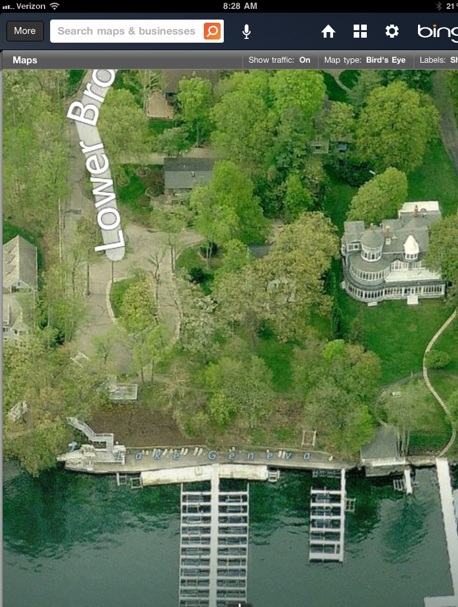

Last week one of these quasi-lakefront properties sold. The listing on Lower Brookwood was originally brought to market in July of 2011 for $1.579MM and sold last week for $950k. (Not my buyer, nor seller). Do not be confused by the apparent discount from list to sale- the property was never worth $1.579MM. The final list price, after a series of thoughtful reductions, was $1.092MM, leaving that $950k sales price well within the margin of error. I didn’t mind the price so much, though when I showed that house (too many times) this year I always counseled a price with an eight handle would have been the best play.

The home had that rare combination of proximity- it was effectively lakefront to the untrained eye- along with a slip, a buoy, and a quite pleasing view. The home was not without warts however, as the finishes were dated and the location was immediately adjacent the Brookwood association parking lot. The property was nice enough, and a Fontana location that feels like lakefront for $950k is fine by me any time it occurs.

That’s the sale but now comes the part where we have to wonder if it was a really good sale or just some normal function of a normalizing market. If I’m a buyer, I can see the benefits of this property. The taxes were relatively low when compared to private lakefront, and the amenities fairly similar. The cost of ownership will be less, given that the association handles the pier maintenance. But aside from that, there are no real benefits to owning quasi-lakefront over owning the real deal. There is no one that would prefer sitting on a pier with 40 other people if they could sit on a pier by themselves. I guess some people would choose the crowd, but we can’t trust those people.

I’m going to assume that today there is at least one private lakefront home that would sell around $1.15MM. At that rate, the price paid to graduate from sort-of-lakefront to real-honest-lakefront is a mere $200k. That’s a lot of money, don’t get me wrong, and according to the administration if you had that amount of money coming in on an annual basis you’d be darn near a real live millionaire or billionaire, but in the scheme of a lakefront market as pricy as ours is that $200k, or perhaps 20% is a small premium to pay for blue chip property. Over time, the quasi-lakefront home will likely not appreciate at the same favorable clip as the private frontage, so by that measure pure lakefront is the better play. If we can find regular lakefront for a 20% premium over this pretending lakefront, then that’s a value play that we have to always make.

In the aerial, the subject house is the one obscured by trees, not the Echoes…