Sometimes, houses just don’t want to sell. If I list a house, it’s only natural that I then go about trying to sell it. Agents are wonderful at writing bullet point lists that contain the myriad items that make up their individual sales approach, but there’s really just one thing that matters. Well, two. Or three. First, the agent handling the sale has to be attuned to the market that the property abides in, and they have to be competent. Legions of agents will fail these first two tests. Then, thirdly, and most importantly, the price has to be right. With an adept agent and the right price, the other bullet points won’t matter. But we do advertising in the Sunday Shopper! Who cares.

For proof, consider that more than half of the 21 closed lakefront sales from 2012 were properties that had been reduced at least once during their time on the market. And that’s only considering the market tenure that led to the sale- not the entire history of that particular property on the open market. Price is really the only thing that matters. That’s why many agents have adopted a reduction calendar that signals price reductions, even if very small ones, with alarming frequency. There’s something to be said for this style of listing presentation, though I’m not a particularly big fan of it. I will forever be reticent to ask sellers for price reductions even if they are desperately needed. Some sellers just don’t want to hear that their property is 30% overpriced.

The market in December features plenty of these reduced price wonders, but the market is nothing if not picked over. The lake access inventory has grown a bit stagnant of late, with very few new offerings and just the expected dropping off of certain places that have long overstayed their welcome. The lakefront itself is a similar story, with mostly picked over listings remaining. When a new lakefront hits, as one did this morning ($1.299MM on Walworth Avenue in Williams Bay, and I’m not a fan), and as one did the other day (South Lakeshore, Fontana $2.799MM = Big Fan), they attract plenty of attention. While I doubt Walworth Avenue will sell, it’s likely that the South Lakeshore property will have the Lexus ad reps over in a couple weeks, desperately attempting to put a big bow on the roof.

For the remaining few days of 2012, there are plenty of things to look for. We should see most of the pending inventory on and around the lake close by year’s end. That’s obviously a function of coming tax increases, and sellers will be anxious to lock their gains or stomach their losses before the capital gain rates re-sets to a more “fair” percentage. With these sales coming to a close, we’ll likely finish of 2012 in a most spectacular fashion. The lakefront numbers will more than likely exceed those total volume figures of any year since 2006, and we’ll be at a volume pace that looks so much more like the peak of the 2000s than it does the mildly recovered 2012.

For buyers, there are two things to do right now. Either get motivated in a real hurry and go out and try to take advantage of a seller looking to shed property before capital gains rates take effect, or just sit back and wait for the new properties to hit the market in January. Remember, seller’s will list in December, but the vast majority of them will wait until January. Historically our spring rush begins around Super Bowl Sunday. This coming year, barring any adverse weather, I see the market cranking up in early January. Sellers will not wait to list as they have done in the past, and we should see a new crop of lakefront and lake access homes coming to market very early in the new year.

For anyone looking to lock in what will likely be the sub-$2MM deal of the year, Folly Lane ($1.899MM) with it’s wide frontage and 2 acres of woods continues to wait for you, rather impatiently.

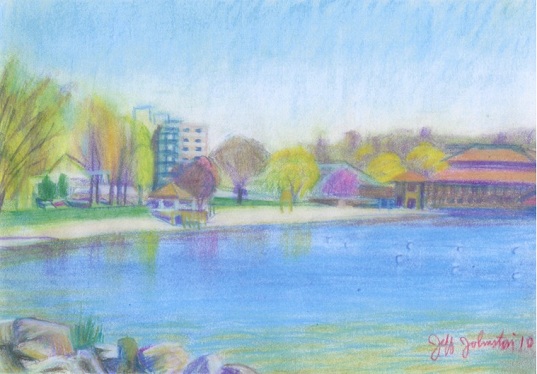

Image again courtesy Jeff Johnston.